The Ultimate Guide To Offshore Business Formation

Table of ContentsAn Unbiased View of Offshore Business FormationThe Greatest Guide To Offshore Business FormationOur Offshore Business Formation StatementsLittle Known Facts About Offshore Business Formation.The Ultimate Guide To Offshore Business FormationGet This Report on Offshore Business Formation

Normally talking, the Cons will vary in a case-by-case scenario. The country where the business is signed up will certainly enforce corporate earnings tax obligation on its globally revenue. Furthermore, the company will be needed to report its globally income on its house nation's income tax return. The procedure of establishing an overseas company is much more complicated than developing a routine company.

Establishing an overseas company doesn't provide any kind of financial savings because you still pay tax obligation on your around the world revenue. If you wish to lower your worldwide tax problem, you ought to think about establishing numerous business rather than one offshore entity. Once you relocate money out of an overseas location, you will certainly be accountable for that earnings in your house nation.

The Best Strategy To Use For Offshore Business Formation

The compromise is that offshore companies incur fees, expenses, and also various other disadvantages. If you plan to incorporate offshore, after that you need to understand regarding the pros as well as cons of incorporating offshore. Every location and territory is various, as well as it's tough to actually understand real efficiency of an offshore company for your organization.

If you want evaluating Hong Kong as an alternative, call us for even more information and among our professionals will stroll you with Hong Kong as an offshore unification option (offshore business formation).

Discover the benefits and drawbacks of establishing up an overseas company, consisting of privacy as well as minimized tax obligation responsibility, and also find out just how to register, establish, or integrate your service outside of your nation of home. In this short article: Offshore companies are companies registered, established, or incorporated beyond the nation of house.

Top Guidelines Of Offshore Business Formation

If a legal opponent is going after lawful activity versus you, it generally includes a possession search. This makes certain there is money for payments in case of a negative judgment against you. Developing offshore firms and also having actually assets held by the overseas company suggest there is no more a link with your name.

The statutory commitments in the operating of the offshore entity have actually additionally been simplified. Due to the absence of public signs up, showing ownership of a business registered offshore can be difficult.

One of the primary disadvantages is in the location of compensation and distribution of the properties and Discover More also earnings of the overseas business. When cash get to the resident nation, they are subject to taxation. This can negate the benefits of the first tax-free environment. Reward income gotten by a Belgian holding company from a firm based elsewhere (where income from international resources is not tired) will certainly pay corporate revenue tax obligation at the normal Belgian rate.

Offshore Business Formation - An Overview

In Spain, holding back tax of 21% is payable on interest as well as returns settlements, whether domestic or to non-treaty countries. Nevertheless, where returns are paid to a firm that has share capital that has actually been held during the prior year equivalent to or above 5% withholding tax obligation visit this page does not apply. This implies that tax is deducted before monies can be remitted or moved to an overseas company.

The major thrust of the legislation is in compeling such firms to demonstrate beyond an affordable question that their hidden activities are genuinely executed in their particular offshore center which these are certainly regular company activities. There are huge tax obligation threats with providing non-Swiss firms from exterior of Switzerland.

An additional factor check this to consider is that of reputational threat - offshore business formation.

Everything about Offshore Business Formation

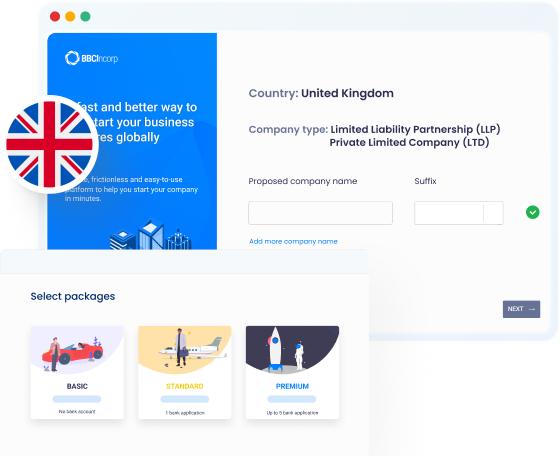

The offshore firm registration process have to be undertaken in complete guidance of a business like us. The requirement of going for offshore firm registration procedure is needed before establishing a business. As it is needed to fulfill all the problems after that one should describe a correct organization.

Take advantage of no taxes, audit as well as bookkeeping, as well as a fully clear, low financial investment endeavor. When selecting a procedure that needs correct focus while the fulfillment of rules and policies then it is necessary to comply with particular actions like the solutions provided in Offshore Company Formation. To find out more, please full our and an agent will certainly touch in due training course.

India, China, the Philippines, Poland, Hungary, Ukraine, Brazil, Argentina, Egypt, and South Africa are a few of the finest countries for overseas advancement.

Get This Report on Offshore Business Formation

There are several reasons why entrepreneurs may want establishing up an overseas firm: Tax obligation benefits, low conformity prices, a helpful banking atmosphere, as well as brand-new profession opportunities are several of the most frequently pointed out reasons for doing so. Below we take a look at what entrepreneurs need to do if they want to establish a Hong Kong offshore company (offshore business formation).

This is because: There is no need for the business to have Hong Kong resident supervisors (a typical need in other nations) as Hong Kong adopts a plan that favors overseas companies established by foreign capitalists. offshore business formation. There is no demand for the company to have Hong Kong resident investors either (a common need somewhere else) foreign entrepreneurs do not need to companion with a regional homeowner to refine a Hong Kong company arrangement.